The march of technology continues to generate great wealth in Asia. Some investment analysts now believe in addition to investing in the pure technology sectors, such as AI and big data, other sectors are worth reviewing under the investment theme technology disruption. Two prominent candidates are fintech and healthcare.

There is little doubt investing in technology disruption is gaining momentum, especially in Asia, where markets such as China lead the growth and development of the technology industry.

"The huge potential of disruptive technologies remains of utmost interest to our clients and partners," says Amy Lo, chairman and head Greater China at UBS Wealth Management and country head of Hong Kong.

Technology has been a source of wealth. "Seventeen percent of the Forbes top 100 billionaires come from technology as well as the largest number of billionaires under 40," says Lo.

There are five mainstream techs nowadays - namely AI, augmented reality/virtual reality (AR/VR), big data, cloud computing and 5G - that will transform many industries over the next decade, according to Lo, noting that these sectors are expected to grow in aggregate by an average 12.8% annually, from US$420 billion in 2017 to US$1.1 trillion in 2025.

But what should investors focus on when investing in technology disruption? On top of the pure technology space, there are quite a few investment themes around the disruptive trends, including: fintech, healthcare, enable tech, blockchain, gaming, and digital data.

Among these themes, the most prominent ones in the next few years might be fintech and healthcare, according to Sundeep Gantori, equity analyst at the chief investment office of UBS Global Wealth Management.

"In 2017, the fintech revenue rose to US$120 billion. We expect it to be more than doubled, reaching US$ 265 billion in 2025," according to Gantori, noting that the industry is expected to grow three times faster than the financial sector.

However, fintech penetration was close to 2.4% last year, according to Gantori.

"We believe the fintech penetration will continue to accelerate, as we believe both the startups and the traditional banks will continue to invest in this space," he adds.

Healthtech, on the other hand, is the next big thing in technology disruption given the large market size and low technology penetration, according to Gantori.

"Today the total size of the healthcare industry is slightly above US$100 billion," says Gantori.

China, as one of the most important markets in Asia, is supporting the development of the healthcare industry. By 2030, China's healthcare market is expected to reach 16 trillion yuan (around US$2.3 trillion), according to the "Healthy China 2030 Plan" (《"健康中国2030"规划纲要》) released by China's State Council in October 2016. The top regulators have been rolling out supporting regulations in terms of integrating technologies such as big data and AI with healthcare.

Broadly speaking, investment opportunities can be found in the sub-industries within the healthtech space, including AI, big data, telemedicine, remote monitoring, the application of technology in drug development, image-guided therapy and robotic surgery, according to Gantori.

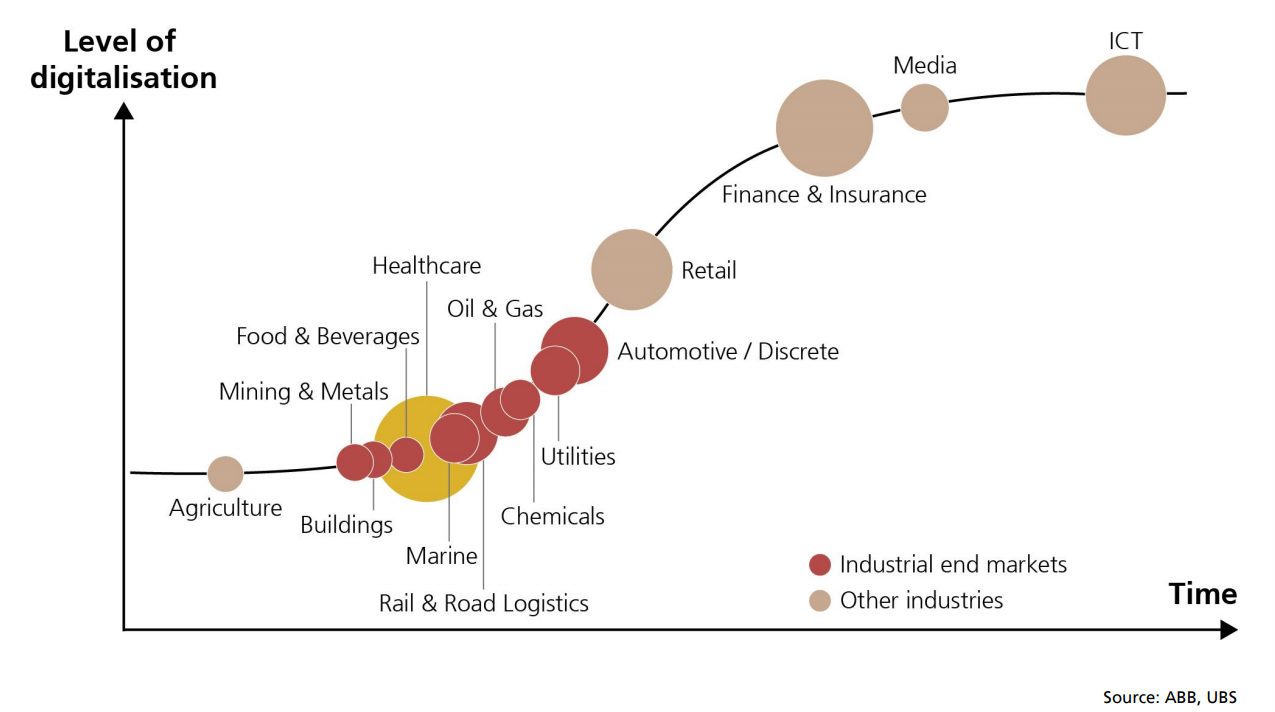

It is interesting to note that the healthcare industry is one of the least digitized industries today. Technology penetration in healthcare is still at an initial stage.

"Within the healthcare sector, as an industry, despite its huge market size, the technology penetration is very limited today – less than 2%," says Gantori, noting that healthtech is expected to generate great opportunities in the next decade.