Hong Kong investors allocate the second least to sustainable investments among their Asian peers, according to a recent report by Schroders. And most Hong Kong investors blame these findings on the lack of information - such as how sustainable fund managers are engaging with the companies they invest in.

Schroders's report suggests Hong Kong investors collectively allocated 25% of their entire investment portfolio to sustainable investments. This figure is about a third lower than the global average of 37% and the Asian average of 37%. Japan (24%) represents the only market in Asia reported to be lower than Hong Kong's allocation.

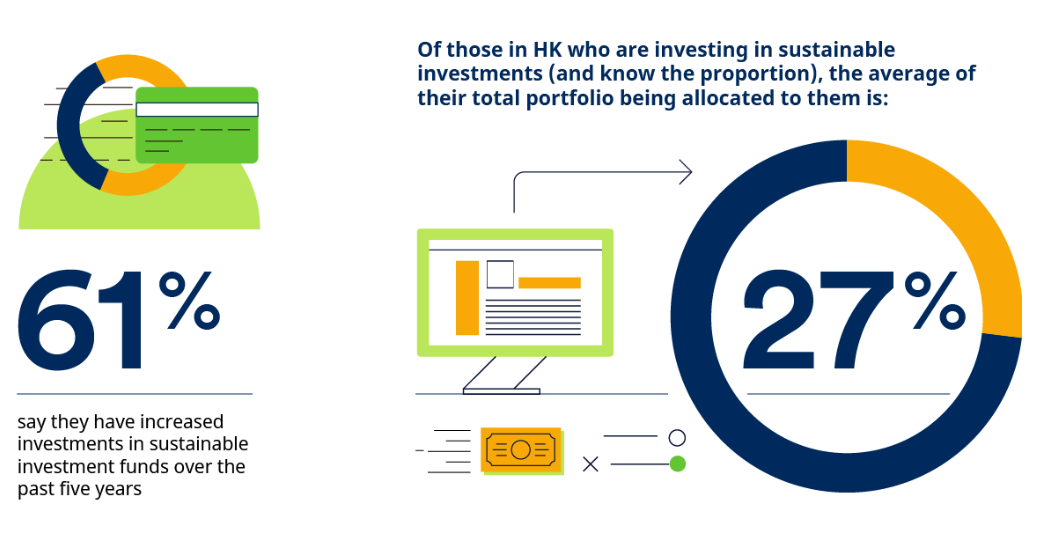

According to the report, only 61% of investors had increased their sustainable investments compared to five years ago. For those in Hong Kong who are investing in sustainable investments and know the proportion invested sustainably, the average of their total portfolio thus allocated is 27%, says the report.

Source: Schroders

One of the main issues that prevent Hong Kong investors from investing in sustainable investments is the lack of information, with 63% of the respondents pinpointing this factor. Some Hong Kong investors (31%) think there is a lack of advice more widely available on sustainable investment, and others (28%) say they are not sure which investments take a sustainable approach.

Other respondents (20%) think there is a lack of information available on how sustainable fund managers are engaging with the companies they invest in, and 18% of the respondents don't understand what sustainable investment entails.

But the myth that sustainable investment is bad for returns is abating. According to the report, only 29% of Hong Kong respondents feel they are prevented from investing in sustainable investments due to concerns that they would not deliver as good a return as non-sustainable investments.

Moreover, Hong Kong shows a strong interest in sustainable investing. A recent report by UBS shows that 85% of Hong Kong investors say they are interested in sustainable investing. Eight in ten (82%) Hong Kong investors say sustainable investing has become more important to them over the past five years, Schroders reveals.

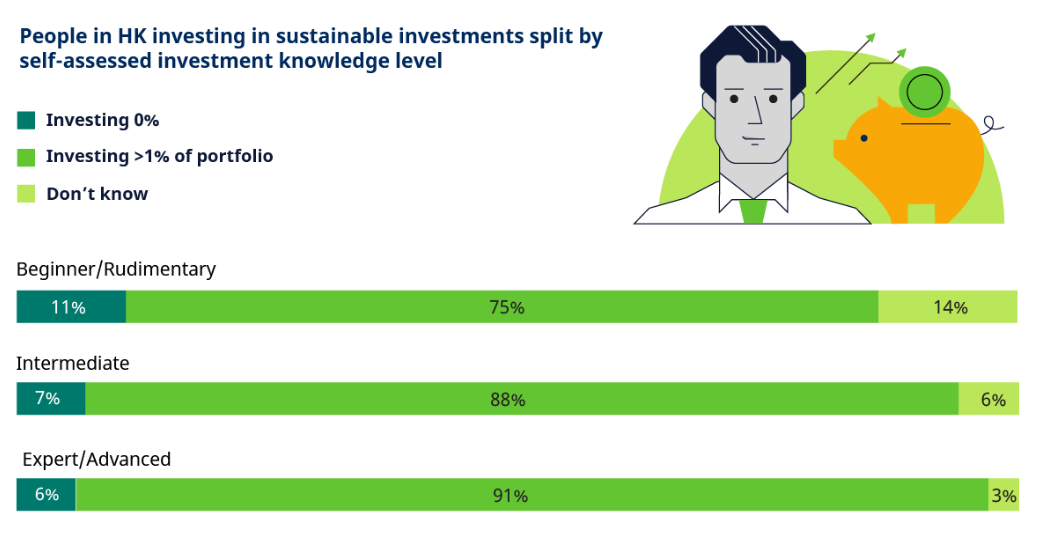

UBS finds interest in sustainable investment is particularly high among women (94%) and younger investors (96%). And Schroders finds those who feel they have a higher level of investment knowledge are more likely to be investing in sustainable investments.

Source: Schroders

Source: Schroders

For those who are interested in sustainable investing, most are concerned with governance – according to Schroders, ending bribery ranked the top among the Hong Kong respondents. Other notable issues that Hong Kong investors care about in environmental, social and governance (ESG) include pollution and renewable energy, climate change, selling unhealthy or addictive products, treatment of company workforce, and the diversity of a company's workforce.