Bolstered by a resilient economy, large population and rich natural resources, Indonesia’s initial public offering (IPO) market is poised for growth in 2023 despite the volatile global market situation.

Whether it is focus on new economy opportunities or companies looking to take advantage of the electric vehicle (EV) value chain, there already has been a healthy pipeline of companies looking to go public this year.

In Q1 2023, Indonesia was the most active IPO market in Southeast Asia with 30 IPOs raising around US$828 million, according to data from EY. Across Southeast Asia around the same period, there were 51 deals raising US$1.4 billion worth of proceeds.

Companies listed in Indonesia raised around US$2.1 billion in IPO proceeds compared with US$1.2 billion during the same period last year. Indonesia is ranked second behind mainland China in terms of IPO proceeds in the Asia-Pacific region, ahead of markets such as Hong Kong, South Korea and India, according to data from Dealogic, May 2023 year to date.

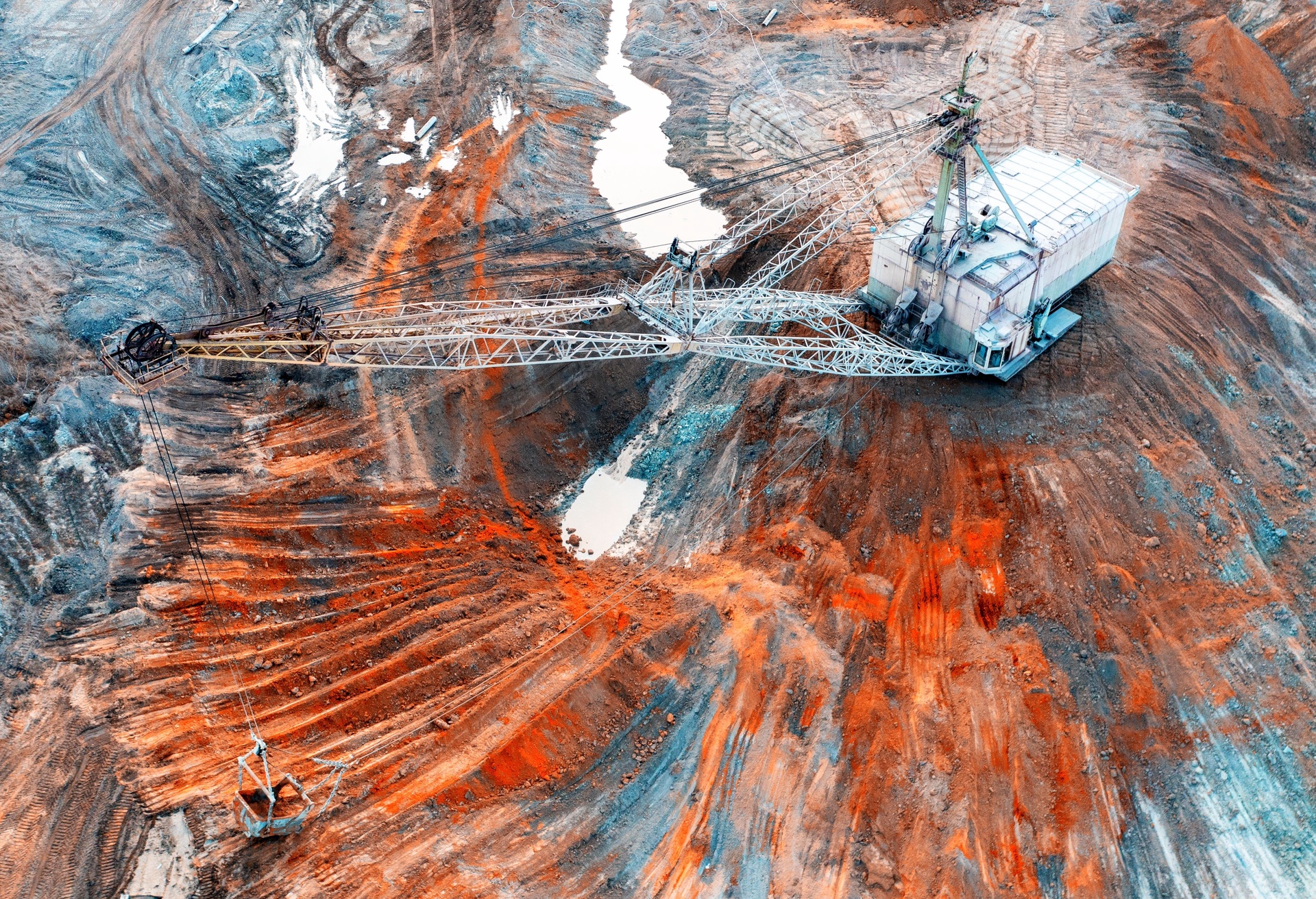

Just last month, Indonesian nickel company Trimegah Bangun Persada (Harita Nickel) raised 10 trillion rupiah (US$672 million) from its public offering. It was the largest IPO in 2023 so far for Indonesia. This was followed by Merdeka Battery Materials’ US$580 million listing that saw shares listed at the top of the offering range.

“The quality of the investor base for this IPO, particularly against the backdrop of challenging market conditions, demonstrates the strength of investor confidence in Indonesia’s ambitions to develop an end-to-end EV supply chain,” shares Gareth Deiner, lead partner at Clifford Chance, which worked on the Harita Nickel transaction.

Investors in both deals were banking on growth prospects in supporting the demand for lithium-ion/lithium polymer batteries for EVs. Commodities like nickel, cobalt and manganese are just some of the key components needed to create batteries for EVs, which are increasingly becoming common.

The pipeline for IPOs in Indonesia, according to market reports, is expected to be robust, mostly coming from the consumer, technology and energy sectors. Some notable names include the upstream arm of Pertamina Hulu Energi, which plans to raise at least 20 trillion rupiah (US$1.36 billion) from investors, and state fertilizer firm Pupuk Kalimantan Timur.

As well, capital market development in Indonesia looks encouraging, with the Asian Development Bank predicting 4.8% GDP growth for the country in 2023.